Tracking your expenses and income is essential for effective budget management, and GoodBudget provides a user-friendly platform to help you achieve this. In this step-by-step guide, we’ll show you how to add income to your GoodBudget account effortlessly. Whether you’re receiving a paycheck or any other form of income, GoodBudget makes it simple to stay organized and informed about your financial situation.

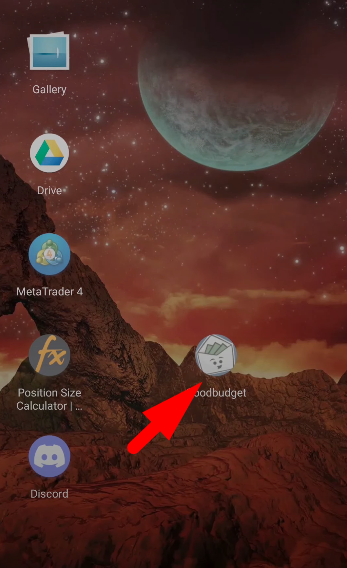

Step 1: Open the GoodBudget App Begin by opening the GoodBudget app on your device. Once opened, navigate to the main screen where you’ll see the “envelope” icon located at the top right corner.

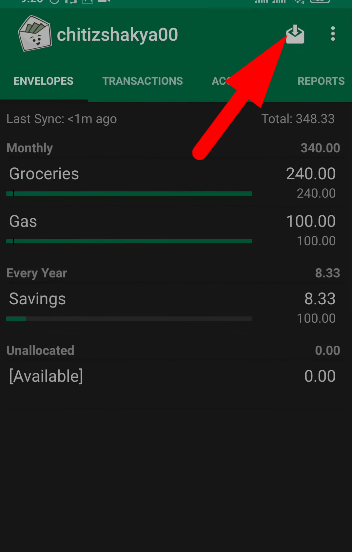

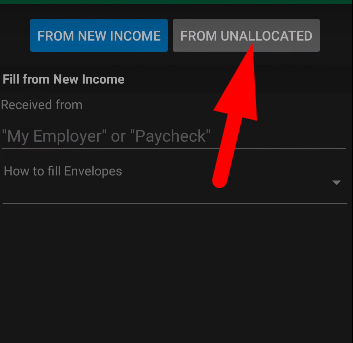

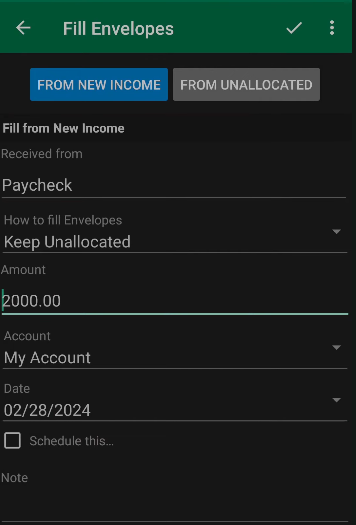

Step 2: Select “From New Income” Tap on the “envelope” icon and choose the “From New Income” option. This will allow you to add a new income source to your GoodBudget account.

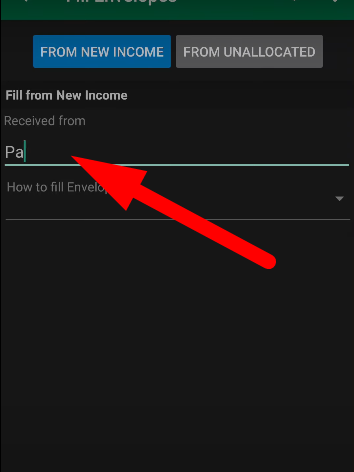

Step 3: Name Your Income Give your income source a name that accurately reflects its origin, such as “Paycheck” or “Freelance Income.” This helps you easily identify and categorize your income within GoodBudget.

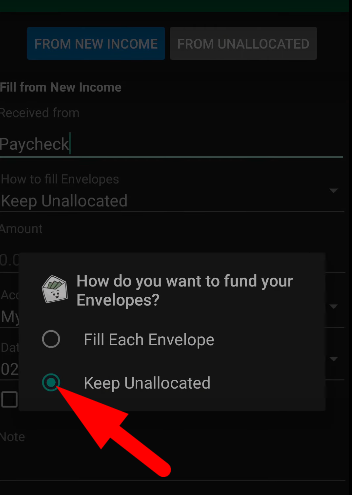

Step 4: Enter the Amount Next, enter the amount of income you’ve received. This could be your monthly salary, a one-time payment, or any other form of income. Tap on “Keep Unallocated” to proceed.

Step 5: Add Additional Details (Optional) You can optionally add more details, such as the date of the income received, notes, or reminders. This provides additional context and helps you better track your income over time.

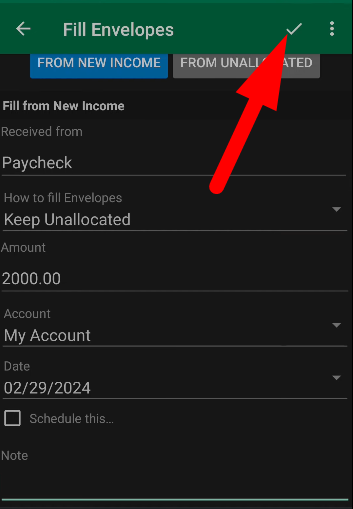

Step 6: Save Your Entry Once you’ve entered all the necessary details, tap on the checkmark or “Save” button at the top right corner of the screen. Your new income entry will now be saved and added to the unallocated section of your GoodBudget account.

Conclusion:

Congratulations! You’ve successfully added income to your GoodBudget account. With this simple process, you can accurately track your finances and stay on top of your budgeting goals. If you found this tutorial helpful, be sure to subscribe, share, and give this video a thumbs up. Thank you for choosing GoodBudget, and happy budgeting!

Sourav is a seasoned financial expert with over 10 years of experience in the industry. He has worked with leading financial institutions, offering expert advice on personal finance, investments, and financial planning. With a deep understanding of banking and market trends, Sourav is dedicated to empowering individuals with the knowledge to make informed financial decisions. His passion is to simplify complex financial concepts and help others achieve long-term financial success.